What are Bear?

Bear : An operator who expects the share price to fall

Bear Market : A weak and falling market where buyers are absent, also when there is high supply but demand is low of any asset.

Who are Bulls?

Bull : An operator who expects the share price to rise and takes position in the market to sell at a later date.

Bull Market : A rising market where buyers outnumber the sellers, also the rising demand of any asset.

A bull market is one where prices are rising, whereas a bear market is one where prices are falling. The two terms are also used to describe types of investors.

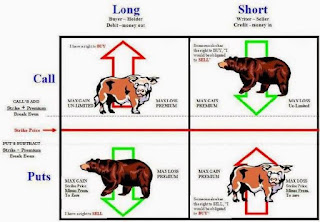

A stock market bull is someone who has a very optimistic view of the market. they may be stock-holders or maybe investors who aggressively buy and sell stocks quickly. A bear investor, on the other hand, is pessimistic about the market and may make more conservative stock choices. Sometimes, the terms are used to refer to specific funds or stocks. Bear market funds, for example, are those that are falling and faring poorly. Investors sometimes refer to bull stocks to describe securities that are aggressively rising and making their investors money.

Knowing what is meant by the bear and bull market can help you understand whether the market is currently rising or falling. There is no need to get frightened by a bear market indicator however, as experts agree that the market is cyclical. When prices start falling, they will eventually rise too.

So the question arises What Drives Bear and Bull Markets?

The stock market is affected by many economic factors. High employment levels, strong economy, and stable social and economic conditions generally build investor confidence and encourage investors to put their money in the stock market. Often, this can bolster bull markets. Also new technologies and companies that encourage investors to put their money in stocks can create bull markets. For example, in the 1990s, the dot com craze encouraged many investors to put their money in stocks that they felt would keep increasing. In some cases, a bullish market is simply self-perpetuating. Since the market is doing well, it only encourages investors to invest more money or to start investing.

On the other hand, discouraging economic or social political changes in a society can push the market down. Sudden instability or unemployment or even fears of unemployment caused by wars and other problems can start to make investors more conservative and therefore lead to bear markets. Of course, again this becomes a self-perpetuating trend. As the economy slows down, companies begin downsizing. Increased unemployment makes people far less willing to gamble on the stock market. Sometimes, a panic caused by dire predictions about the market can also create bearish conditions.

Bears and Bull can impact adversely to market movement, so always choose to be an investor rather than becoming a Bull or Bear. Investor makes right decisions buying when markets are Bearish and booking profits when markets become Bullish.

.jpeg)