Lets start with further myths on option trading

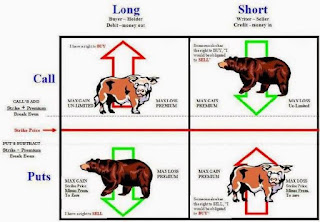

4) Selling option naked

Did you know that selling naked puts has the same P/L profile as selling covered calls? Yet most brokers allow traders to sell covered calls in their accounts, but not naked puts? I find it extremely ignorant. An alarming number of financial professionals, including stockbrokers, financial planners and journalists are in position to educate the public about the many advantages to be gained from adopting naked put writing (and other option strategies), but fail to do so. Many public investors never bother to make the effort to learn about options once they hear negative statements from professional advisors.

Writing naked put options is a significantly more conservative strategy and definitely less risky than simply buying and owning stocks. As such it deserves to be considered as an attractive investment alternative by millions of investors.

5) 99% of stocks expire worthless

Approximately 10% of options are exercised (The trader takes advantage of their right to buy or sell the stock). Around 55%-60% of option positions are closed prior to expiration. Approximately 30%-35% of options expire worthless.

Did you know that selling naked puts has the same P/L profile as selling covered calls? Yet most brokers allow traders to sell covered calls in their accounts, but not naked puts? I find it extremely ignorant. An alarming number of financial professionals, including stockbrokers, financial planners and journalists are in position to educate the public about the many advantages to be gained from adopting naked put writing (and other option strategies), but fail to do so. Many public investors never bother to make the effort to learn about options once they hear negative statements from professional advisors.

Writing naked put options is a significantly more conservative strategy and definitely less risky than simply buying and owning stocks. As such it deserves to be considered as an attractive investment alternative by millions of investors.

5) 99% of stocks expire worthless

Approximately 10% of options are exercised (The trader takes advantage of their right to buy or sell the stock). Around 55%-60% of option positions are closed prior to expiration. Approximately 30%-35% of options expire worthless.

The truth is that options may be used as insurance policies. They can be used as risk management tools, not only trading vehicles.

As Mark Wolfinger explains here: “If I buy a call option and earn a profit by selling at a higher price, there is no reason to believe that the seller took a loss corresponding to my gain. The seller may have hedged the play and earned an even larger profit than I did. I don’t see anything resembling a zero sum game in hedged options transactions. I understand that others see it as black and white: If one gained, the other lost. But that’s an oversimplification

7) Only options sellers make money

The truth is that both option buyers and sellers can profit from option trading. If only sellers made money, there would be no buyers. With no buyers there would be no market. While options selling does have an edge in many cases, it also exposes you to negative gamma.

As Mark Wolfinger wrote: “Premium buying is the less-traveled road, but it can be profitable for the well-prepared, disciplined trader. It doesn’t mean it is better or worse than premium selling. It just means that there is more than one road to Rome.”

As Mark Wolfinger wrote: “Premium buying is the less-traveled road, but it can be profitable for the well-prepared, disciplined trader. It doesn’t mean it is better or worse than premium selling. It just means that there is more than one road to Rome.”

.jpeg)

No comments:

Post a Comment